Blog

How FinTech is Transforming Traditional Banking in 2024

What is FinTech? And Why is it Disrupting Banking?

FinTech, short for financial technology, encompasses a broad range of technological innovations designed to improve and automate financial services. From mobile payment apps to blockchain-based systems, FinTech solutions offer customers more personalized, efficient, and transparent ways to manage their money.

The industry has grown from being a disruptor to a collaborative partner with traditional banks, driving changes that were unimaginable a decade ago. Banks are now forced to innovate, integrate, and adapt—or risk becoming obsolete in a fast-moving, tech-driven world.

Key Transformations in Traditional Banking Through FinTech

1. Enhanced Customer Experience Through Technology

In the past, visiting a branch or calling customer service meant long wait times and limited options. FinTech has changed this narrative, making financial services accessible through user-friendly apps and platforms.

Traditional banks are now following suit, offering:

- AI-driven chatbots to provide 24/7 customer support.

- Personalized dashboards powered by data analytics for tailored financial insights.

- Voice-activated banking that integrates with smart home systems for easy account management.

These tools allow customers to access banking services anytime, anywhere, reducing reliance on physical branches.

2. Real-Time Payments: Instant Gratification Meets Finance

Gone are the days of waiting several business days for transactions to clear. FinTech has introduced real-time payment systems, allowing money to be transferred instantly across borders and platforms.

Banks are upgrading their payment systems or partnering with FinTech firms like PayPal and Stripe to stay competitive. This shift benefits individuals and businesses alike, enabling faster payroll processing, immediate supplier payments, and seamless peer-to-peer transfers.

3. Open Banking and API Integration

Open banking, driven by FinTech, has democratized financial data. By allowing customers to share their banking information securely with third-party providers, open banking fosters innovation in financial tools and services.

Examples include:

- Budgeting apps that analyze spending habits across multiple accounts.

- Loan marketplaces that match customers with the best rates.

- Investment platforms offering automated portfolio management.

Banks that embrace open banking initiatives are able to offer these features through API integrations, enhancing their value proposition to customers.

4. Financial Inclusion: Banking for All

FinTech has broken barriers to financial access by creating low-cost, mobile-first solutions that serve previously unbanked or underbanked populations. Digital wallets, microloans, and online savings platforms have given millions of people access to financial services for the first time.

Traditional banks, long limited by high overhead costs, are learning from FinTech’s leaner models and launching their own inclusive banking solutions.

5. Blockchain and Cryptocurrency: The New Frontier

Blockchain technology has introduced unparalleled security and transparency to financial transactions. While initially skeptical, many traditional banks now recognize the value of blockchain for secure record-keeping, cross-border payments, and even smart contracts.

Cryptocurrency adoption is also growing. Some banks have begun offering custodial services for digital assets, while others are exploring how to integrate cryptocurrency into their payment systems.

6. AI and Machine Learning in Lending and Credit

AI-powered credit scoring models are revolutionizing lending by considering alternative data sources like utility bills, online transactions, and social media behavior. This approach reduces bias and enables fairer access to credit.

Traditional banks are investing in similar AI tools to speed up loan approvals, predict default risks, and optimize interest rates. This transition not only improves efficiency but also expands their customer base to include individuals with non-traditional credit histories.

Challenges for Traditional Banks

While the benefits of FinTech are undeniable, the transition has not been seamless for traditional banks. Some of the challenges include:

- Legacy Systems: Many banks operate on decades-old IT infrastructure, making it difficult to adopt new technologies.

- Regulatory Compliance: As FinTech introduces new ways to handle money, governments are tightening regulations, posing additional hurdles.

- Cybersecurity Risks: With greater reliance on digital systems comes an increased threat of data breaches and cyberattacks.

- Cultural Shift: The shift from in-person service to digital-first interactions requires a cultural overhaul, both internally among employees and externally for customers.

Despite these challenges, banks that embrace innovation have the opportunity to evolve into agile, tech-driven institutions capable of thriving in this new era.

Collaboration vs. Competition: The New Dynamic

Rather than viewing FinTech as a competitor, many banks are choosing to collaborate with FinTech companies. Partnerships between the two are reshaping the financial landscape, enabling:

- Co-branded services, such as digital wallets or co-developed apps.

- FinTech-driven banking models, like hybrid branches equipped with tech kiosks for faster services.

- Joint investments in emerging technologies like AI, blockchain, and biometrics.

This collaborative approach allows traditional banks to leverage the agility of FinTech while maintaining their customer trust and compliance expertise.

The Future of Banking in a FinTech-Driven World

The convergence of FinTech and traditional banking will only accelerate in the coming years. We can expect to see:

- Hyper-personalization: Financial products tailored to individual preferences using predictive analytics.

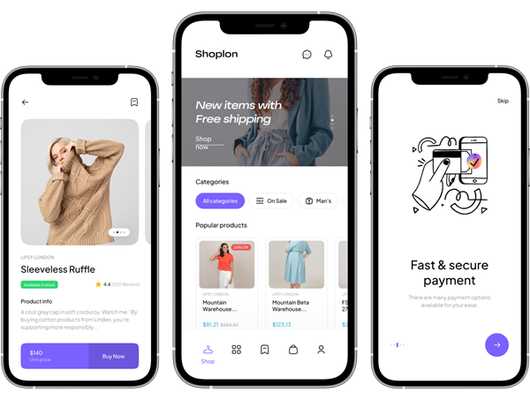

- Embedded finance: Banking features seamlessly integrated into non-financial platforms like e-commerce or social media apps.

- Decentralized banking: Greater adoption of blockchain for trustless, borderless financial systems.

For customers, this evolution means a more empowered financial experience with fewer barriers and more choices. For banks, it’s a call to innovate or risk irrelevance.

Conclusion

In 2024, FinTech is not just transforming traditional banking; it is redefining what banking means. The industry is moving towards a future where financial services are smarter, faster, and more inclusive. As banks and FinTechs continue to collaborate and compete, the ultimate winners are the customers, who gain access to better, more accessible financial solutions.

The transformation is far from over, and as we look ahead, one thing is clear: the era of tech-powered banking is just beginning.

Do you want a free consultation?

Over 15 years of experience, we have developed more than 200 projects, startups, websites, MVPs. Book a free Zoom call with our CTO to discuss how to bring your project to life 🤙

MVP / Mobile apps / Startups / Websites / Bots / Marketplaces / Crypto projects/ API

Contacts

15 Years of Expertise in Cutting-Edge Development

At Zavod-IT, we specialize in building startups, cryptocurrency exchanges, cashback platforms, Telegram bots, and advanced software solutions. With over 15 years of experience, we serve clients across the USA and Europe, delivering high-quality, tailored solutions that meet the unique demands of various industries.

Coiner.cab Corp